Employee ownership is a win-win. Sharing profit with employee owners rewards the people who generated it both financially, and with improved job satisfaction, as employees come to understand exactly how their day–to–day actions make an impact.

Businesses also benefit. A survey of over 40,000 employees across 14 companies in different countries found that employee ownership, when paired with education, creates greater loyalty, increased willingness to work hard, and lower chances of turnover.

“A lot of businesses are hiring people and making them part owners. I thought, 'Why are they doing that?’ But now I get it. When you find someone and give them a percentage of the company and earnings, that person works to make the company better; to make more money and do things more efficiently than someone who’s just taking home a paycheck.”

Angelo B., retired owner Tweet

When employee owners are empowered to see the financial performance of their respective businesses and understand how their work impacts the value of their ownership, they make better decisions within their sphere of influence.

At Teamshares, we’ve transitioned over 80 companies to employee ownership. Over time, we’ll help 10,000 companies become 80% employee-owned. With each company, we refine how best to navigate the transition to employee-owned and operated, and we pass this knowledge to our network companies.

A cornerstone is the importance of employee owner education. Employee ownership is most impactful when every employee owner understands what makes the business financially successful, and how that success benefits them.

Within the first few months of becoming employee-owned, all Teamshares network company presidents initiate employee owner education to help build common understanding.

Financial impact of employee ownership

Employee ownership means employees own part of the business as shareholders. When the business is financially successful, shareholders are entitled to a portion of the profit.

Employee owners at Teamshares network companies benefit financially in two ways: through share ownership that increases over time and dividends.

Share ownership

Shares are what make employees owners. A business is divided into shares which represent a portion of ownership. The higher the value of the company, the more each individual share is worth.

Share ownership benefits employee owners because they receive the cash value of their ownership when they leave the company.

To understand how this works, imagine a company that is worth $1 million dollars. If there are two equal owners, each person’s shares are worth $500,000.

If the business is successful and eventually becomes worth $3 million dollars, each owners’ shares would then be worth $1.5 million. When this business sells, each owner will receive the current value of their shares, which is far greater than the shares’ original value.

Unlike other business ownership arrangements, employee owners at Teamshares network companies don’t have to spend their own personal funds to become shareholders.

At the time of acquiring the small business, employees immediately become shareholders as Teamshares grants 10% of its stock to be split among all permanent employees.

Dividends

Dividends are excess cash generated by the business that are divided up and proportionally distributed to owners. For example, if a business generates $1,000 more cash profits than is needed to operate, and there are two equal owners, both will receive a dividend of $500.

As owners of the business, all Teamshares network company employee owners receive dividends when the business generates more cash that it needs.

Dividends typically start as relatively small amounts of cash, but grow as the business performs better and employee owners own a higher percentage of the business.

Together, dividends and share repurchases provide ongoing financial benefit to employee owners.

So how do employees increase the value of their ownership?

How Teamshares uses employee owner education to increase shareholder value

The more financially successful a company is, the higher the value of dividends and shares. This means that every employee owner has a vested interest in learning how to make the company more financially successful.

Employee owner education is anchored by a monthly meeting for shareholders to discuss the state of the company. At these meetings, employee owners learn about the levers and tools they can use to evaluate the business and collaborate on ways to grow it.

Teamshares provides structure and content for these monthly meetings, including videos, activities, and discussion topics about business success.

After the meetings, the company president encourages employee owners to apply these concepts to their day-to-day operations.

The monthly meeting has two goals:

- Provide a forum for employee owners to align on company goals and priorities

- Continually increase the financial fluency of employee owners, so everyone understands how their work impacts both company financials and their individual wealth

Employee owners use the TeamsharesOS custom platform to better understand how the specific company operates and how each person’s work can benefit the company and its shareholders.

TeamsharesOS further facilitates employee education through in-platform discussion questions, activities, and practical knowledge sharing.

Employee owners build financial fluency through the TeamsharesOS platform in three distinct phases, mapped to where they are on their employee ownership journey:

- Introductory: What it means to be an employee owner

- Intermediate: Developing a shared language

- Advanced: Continuous improvement

Phase one: what it means to be an employee owner

Shared ownership isn’t common in small businesses, so most people are not familiar with what employee ownership is, or what it means for them. This is where education begins. What does it mean to be an employee owner?

In the first phase of education, employee owners learn the basic mechanics of ownership at a Teamshares network company, including understanding exactly how excess cash leads to dividends and share repurchases and how each benefits employee owners.

Phase one isn’t about teaching employee owners the meaning of terms like gross margin and EBITDA. Instead, it focuses on showing how their existing practical knowledge as experts in the business can impact the company’s bottom line and, in turn, their earnings.

Phase one concludes when employee owners and the president have set, monitored, and achieved a goal together that improves the business.

This helps employee owners and the president build trust and see each other as capable business operators. At the end of phase one, everyone recognizes the possibility to grow the company and how employee ownership is an effective way to get there.

Phase two: building financial fluency

The objective of phase two is to develop a shared language around financial performance. This helps employee owners foster productive and useful collaboration with each other about how to grow the business.

The shared language? Financial fluency.

Organizational financial fluency means everyone is playing the same game using the same common knowledge about the goals of the business and how to get there.

For example, picture this: It’s the 16th hole, dogleg left, 400 yards, par 4. First shot you drove it down the middle, and now you’re just off the fairway, about 175 yards from the green. Which club do you use?

Non-golfers won’t understand the question. Casual golfers might be able to follow along enough to give a club recommendation. But frequent golfers? They would have questions because they understand the amount of information they were given wasn’t sufficient to understand what club to use. They might ask: How windy is it? How big is the green?

The goal of financial fluency is to turn employee owners into frequent golfers. A dogleg left is just a golf course that turns left, and EBITDA is just a way to understand how much a business earns after operations and before financing decisions.

Knowing how to take the right action in golf and knowing how to take the right action in a business are very similar. You have to understand the ultimate goal and what actions will move stakeholders closer to it, and the role you play.

Income statements

The income statement is a key resource for understanding how a business is performing. In the monthly meeting, employee owners learn what the income statement is, how to read it, and how to use it to gain insight into the financial performance of the business.

To read the income statement, employee owners must first learn its language. To begin, they learn that revenue is what the business earns from selling its product or services.

If a business manufactures garden hoses that are sold for $20, then each time a garden hose is sold, the revenue is $20. Ten garden hoses sold means $200 in revenue.

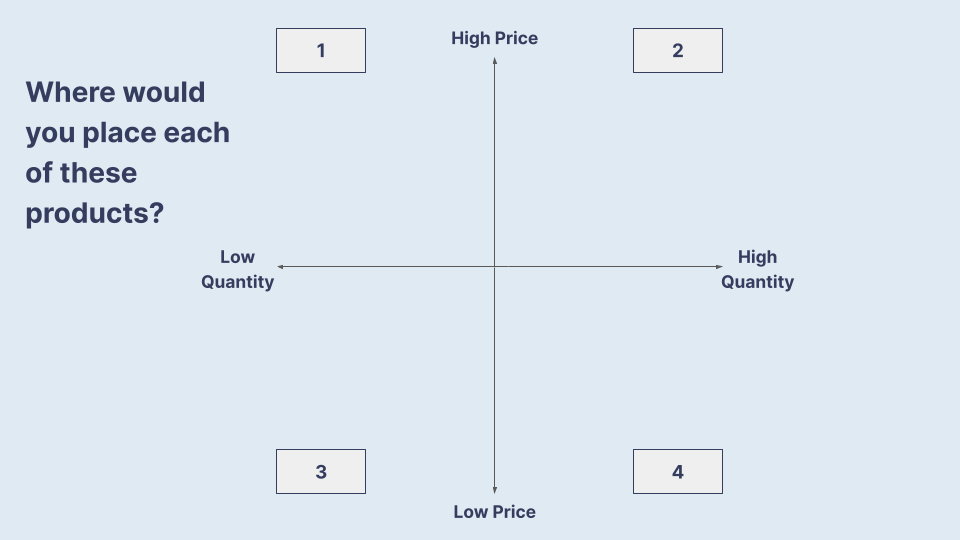

Because thinking about price and quantity matters to financial performance, as part of their education employee owners are asked to place some of the company’s products or services on a grid of price and quantity.

Next, they identify the items that earn the most revenue—those items that are sold at the highest price and in the highest quantity.

In one instance, the price and quantity grid from an employee education session helped employee owners realize one of their products wasn’t doing as well as they thought.

It was selling a lot which seemed like a good thing, but the price of the item was very low.

By calculating revenue as price times quantity, it became clear to the employee owners that despite the high volume, this item was not contributing much to the revenue of the company.

This activity helped employee owners shift their focus to other items that would have a larger impact on revenue.

This is an example of how having a shared language helps employee owners work together to increase the financial performance of a business. Before, employee owners might have said, “We’re selling a lot of this item, so we must be doing well.”

Now, employee owners can look at an income statement and see that while the quantity of an item sold is high, if the price is low, it may not be generating much revenue.

From there, they could discuss options like:

- Raising prices

- Encouraging customers to purchase higher revenue items instead

- Discontinuing the item

The purpose of phase two of employee education is to build this shared knowledge of business operations so employee owners are confident in and capable of taking actions that lead to financial success.

Phase three: continuous improvement

No matter how established or successful a company is, there isn’t a point where the business is ‘figured out’ and it will be successful forever.

For example, Ford’s F-series has been the best selling truck in America for 41 years. Just like a small business, Ford pays careful attention to their customers and the market and continually improves their business lines.

They recognized that demand for electric vehicles was increasing, and new legislation was creating financial incentives to produce more electric cars. So they did something that would benefit the company, their customers, and serve the current market: introduced an electric version of the popular F-150 truck. As a result, Ford became the #2 EV automaker in the U.S. in 2022.

Like Ford, small businesses also need to keep evolving. Improving and adapting to new circumstances is a continuous process.

In phase three of employee owner education, the monthly meeting becomes a venue for continuous improvement, with employee owners reviewing the financial performance and discussing how to improve it.

The difference is, now that they have a shared language around financials, employee owners can lead these meetings themselves.

They can collectively read and understand the income statement and the cash flow statement, and understand the connection between their work and the profit they share. As a result, employee owners now guide the agendas, topics, and goals of the monthly meetings.

By phase three, employee owners aren’t renting a job. They feel and act like owners of a business.

The ongoing impact of education on employee ownership

Businesses in the Teamshares network never have to be sold again because they’re owned by the most local buyer there is—their employees.

Through ongoing education, small businesses in the Teamshares network will continue to grow from 10% to 80% employee-owned within 20 years.

Financially fluent employee owners have the agency to take actions that help the company grow, knowing that the success they create will ultimately benefit themselves and their families.

“Employee ownership means that this is mine, and it's my co-workers’, and we have an interest in it. We're not just working so the boss can get a new car or a bigger house. We're working for ourselves and our future.”

Patty R., network company president since 2021 Tweet

As a shareholder, Teamshares also has a responsibility to the network companies and their success. So we’ll continue to develop education that helps businesses meet new challenges. Ultimately, employee owners will have the agency to run monthly meetings autonomously and create their own path to success.

With financially fluent employee owners, a practice of reviewing the company’s financial performance monthly, and ongoing educational resources, we’re building a network of financially successful businesses that never have to be sold again with employee owners who feel fulfilled and financially secure.

Teamshares writers follow strict principles for sourcing credible information within articles. Any outside information including direct quotes, paraphrased information, and concepts that are derived from external sources adhere to our standards for accuracy and transparency.

- Ford: F-Series Is America’s Best-Selling Vehicle for 41st Year. (2023, January 4). Kelley Blue Book. https://www.kbb.com/car-news/ford-f-series-is-americas-best-selling-vehicle-for-41st-year/

- F-150 Lightning Wins 2023 North American Truck of the Year; Third Consecutive NACTOY Truck of the Year Win for Ford | Ford Media Center. (2023). Ford.com. https://media.ford.com/content/fordmedia/fna/us/en/news/2023/01/11/f-150-lightning-wins-2023-north-american-truck-of-the-year–thir.html

- Kruse, D., Freeman, R., & Blasi, J. R. (2008). Do Workers Gain by Sharing?

- De Spiegelaere, S. (2018). Book Review: How Did Employee Ownership Firms Weather the Last Two Recessions? Employee Ownership, Employment Stability, and Firm Survival: 1999–2011. Transfer: European Review of Labour and Research, 24(1), 123–124. https://doi.org/10.1177/1024258917748293